Elevate your FinTech game with our guide to creating high-performance apps. Explore cutting-edge strategies and essential features for delivering seamless user experiences and staying competitive in the fast-evolving financial technology landscape.

Understanding the FinTech

The FinTech market has experienced exponential growth in recent years, transforming the traditional finance landscape with digital solutions. As the world becomes increasingly interconnected, digital finance has emerged as a powerful force, driving innovation and revolutionizing the financial industry.

Digital finance encompasses a broad range of technology-driven financial services and solutions, empowering individuals and businesses to conduct transactions, manage finances, and access financial resources with ease. The integration of cutting-edge technologies, such as artificial intelligence, blockchain, and cloud computing, has paved the way for a new era of finance.

Developers need to stay up-to-date with the latest advancements in technology-driven finance and understand the unique requirements of the market.

Opportunities in the FinTech Market

The FinTech market has witnessed a surge in investment and adoption across various sectors. From peer-to-peer lending platforms to mobile payment solutions, FinTech companies are reshaping the way financial services are delivered. The key opportunities in the FinTech market include:

- Financial Inclusion: By leveraging digital technologies, FinTech companies can provide financial services to unbanked and underbanked populations, bridging the gap and promoting financial inclusion.

- Convenience and Accessibility: FinTech apps offer individuals the convenience of managing their finances anytime, anywhere. They provide access to banking services, investment opportunities, and financial planning tools at the touch of a button.

- Streamlined Processes: Traditional banking and financial services can be time-consuming and complex. FinTech apps streamline processes, enabling faster transactions, simplified account management, and efficient customer support.

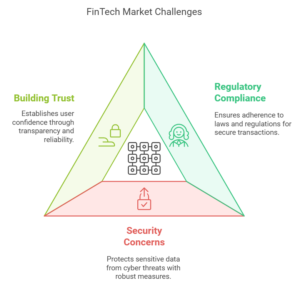

Challenges in the FinTech Market

The FinTech market presents exciting opportunities, it also poses several challenges that developers and entrepreneurs need to overcome. These include:

- Regulatory Compliance: The financial industry is heavily regulated, and navigating the complex regulatory landscape can be daunting for FinTech companies. Compliance with laws and regulations is essential to ensure the security and integrity of financial transactions.

- Security Concerns: As FinTech apps deal with sensitive financial information, robust security measures are crucial to protect user data from cyber threats. Maintaining stringent security protocols throughout the app’s lifecycle is imperative.

- Building Trust: Establishing trust with users is vital in the FinTech market. Users need assurance that their data and transactions are secure. Providing transparent and reliable services is key to gaining user trust and loyalty.

The Future of FinTech

As technology advances, we can expect to see further disruption and innovation in the financial industry. Mobile banking, digital wallets, robo-advisors, and blockchain-based solutions are just a glimpse of what the future holds for FinTech. Developers and entrepreneurs who understand the FinTech landscape, seize the opportunities and address the challenges head-on will be well-positioned to thrive in this rapidly evolving market.

Key Statistics about the FinTech Market

| Key Metric | Data |

| Total Investment in FinTech Market (2020) | $44.9 billion |

| Number of FinTech Startups Worldwide (2020) | 12,000+ |

| Estimated Value of Global FinTech Market (2025) | $309.98 billion |

| Percentage of US Adults Using FinTech Apps for Banking (2021) | 46% |

Key Features of High-Performance FinTech Apps

When it comes to developing high-performance FinTech apps, certain key features and functionalities are essential for success. These features not only optimize app performance but also enhance the overall user experience. Let’s take a closer look at some of these vital elements:

User-Centric Design

A user-centric design is at the heart of every high-performing FinTech app. It focuses on creating an intuitive and seamless user experience that allows users to navigate through the app effortlessly. By prioritizing user needs and preferences, a user-centric design helps build trust, engagement, and customer loyalty.

Robust Security Measures

Ensuring the security of users’ financial information is of utmost importance in the FinTech industry. High-performing FinTech apps incorporate robust security measures such as data encryption, secure authentication, and stringent data protection protocols. By implementing these measures, FinTech apps provide users with the confidence to conduct financial transactions securely.

Speed Optimization

Performance optimization techniques that focus on speed are crucial for high-performing FinTech apps. By minimizing loading times and optimizing processes, these apps offer users a seamless and efficient experience. Fast, responsive interfaces provide users with real-time updates, enabling them to make quick and informed financial decisions.

Intuitive Financial Tools and Features

FinTech apps enhance users’ financial management capabilities. By providing intuitive tools such as budgeting calculators, spending trackers, and personalized financial insights, these apps empower users to take control of their finances effectively. Intuitive features simplify complex financial concepts and make them accessible to users of all backgrounds.

Seamless Integration with Third-Party Services

High-performing FinTech apps leverage API integrations to offer users additional functionality and convenience. By seamlessly integrating with third-party services such as payment gateways, investment platforms, and banking APIs, these apps extend their capabilities, making them more versatile and valuable to users.

Incorporating these key features and functionalities into FinTech apps not only optimizes performance but also enhances the overall user experience. By prioritizing user-centric design, robust security measures, speed optimization, intuitive financial tools, and seamless integration with third-party services, FinTech apps can provide a high-performing, secure, and user-friendly platform for users to manage their finances effectively.

Designing for Speed and Efficiency

When it comes to developing FinTech apps, speed and efficiency are crucial factors for success. Users expect fast, responsive experiences that allow them to access their financial information and complete transactions quickly and effortlessly. To meet these expectations, app designers need to focus on optimizing speed and efficiency throughout the design process.

Streamlined Processes:

One key aspect of designing for speed and efficiency is implementing streamlined processes. This involves simplifying complex tasks and reducing the number of steps required to complete them. By eliminating unnecessary hurdles and minimizing user input, app designers can significantly improve the overall efficiency of the app.

Responsive Interfaces:

Another important consideration is the development of responsive interfaces. A responsive interface adapts to different screen sizes and device types, ensuring a seamless user experience across platforms. By designing interfaces that automatically adjust and optimize content placement, designers can enhance usability and speed, ultimately improving the app’s efficiency.

Minimal Loading Times:

Slow loading times can be a major source of frustration for users. To create a highly efficient app, designers should strive to minimize loading times as much as possible. This can be achieved through various techniques, such as optimizing code, compressing images, and leveraging caching mechanisms. By reducing loading times, designers can enhance the overall user experience and improve the app’s efficiency.

| Benefits of Designing for Speed and Efficiency | Examples |

|

|

|

|

|

|

|

|

Ensuring Robust Security

In FinTech app development, robust security is not just a feature; it is an absolute necessity. With the increasing amount of financial transactions and sensitive data being processed through these apps, ensuring the secure handling of information is paramount to gaining user trust and compliance with regulatory standards.

To achieve a high level of app security, developers must incorporate effective measures such as data protection, secure authentication, and encryption.

Data protection: Implementing comprehensive data protection measures is crucial for safeguarding user information and preventing unauthorized access. This involves implementing industry-standard security protocols, advanced access controls, and secure data storage practices.

Secure authentication: Strong authentication mechanisms, such as biometric authentication and multi-factor authentication, add an extra layer of security to FinTech apps. By implementing secure authentication methods, developers can significantly reduce the risk of unauthorized access to user accounts.

“Investing in robust security measures is not only a legal and ethical obligation but also a competitive advantage. Users need to know that their sensitive financial information is safe and protected.”

Encryption: Encrypting data during transmission and storage is a critical security measure that ensures confidentiality. By encrypting sensitive data, such as user passwords, financial details, and personal information, developers can prevent unauthorized parties from deciphering and accessing this information.

By integrating these security measures into FinTech app development, developers can create a secure environment for users to conduct their financial transactions and manage their accounts.

Integrating APIs for Enhanced Functionality

Integrating APIs (Application Programming Interfaces) can bring enhanced functionality and open up a wealth of opportunities. APIs allow seamless integration with third-party services and efficient data sharing, enabling FinTech apps to offer a comprehensive and personalized experience to their users.

API integration enables FinTech apps to leverage the expertise and infrastructure of trusted third-party providers. Instead of reinventing the wheel, developers can focus on building the core features of the app while relying on established, secure, and well-maintained services for additional functionalities.

APIs facilitate efficient data sharing between FinTech apps and external systems. This seamless exchange of information allows users to securely access their financial data from various sources within a single app, providing a unified view of their financial health.

Benefits of API Integration in FinTech Apps:

- Access to a wide range of third-party services and specialized features

- Enhanced user experience through seamless integration and unified access to financial data

- Streamlined development process by leveraging established third-party platforms

- Increased scalability and flexibility to adapt to changing market needs

- Reduced development costs and time-to-market

Embracing API integration empowers FinTech companies to deliver innovative solutions that cater to the evolving needs of the market.

Optimizing Performance for Scale

Optimizing app performance for scale is crucial to meet the increasing demands of users. FinTech apps need to be able to handle a growing user base without compromising their speed and efficiency. Scalability, performance testing, and load balancing are essential factors in ensuring high performance under heavy user loads.

Scalability

Scalability refers to the ability of an app to handle increased workloads without experiencing performance degradation. In the context of FinTech apps, scalability is essential to accommodate the growing number of users, transactions, and data volume. To achieve scalability, developers use techniques such as horizontal or vertical scaling, database sharding, and caching data to optimize performance.

Performance Testing

Performance testing plays a vital role in identifying bottlenecks, optimizing resource usage, and ensuring that the app performs well under different conditions. This testing phase includes load testing, stress testing, and endurance testing to simulate real-world scenarios and measure the app’s response time, throughput, and resource utilization. By conducting comprehensive performance testing, developers can fine-tune the app’s infrastructure and optimize its performance for scalability.

Load Balancing

Load balancing is the process of evenly distributing incoming network traffic across multiple servers or resources to prevent overloading and ensure efficient resource utilization. Load balancing helps distribute user requests, transactions, and data processing tasks across multiple servers or instances. This ensures that no single server or resource becomes overwhelmed and leads to performance degradation.

Testing and Quality Assurance

In the development of FinTech apps, comprehensive testing and quality assurance processes play a critical role in ensuring a high-performing and bug-free product. By meticulously testing every aspect of the app, from functionality to security, developers can identify and fix any issues before they reach the end users.

Testing Process:

There are various testing methodologies that FinTech companies employ to validate the app’s performance and functionality. These include:

- Unit Testing: Testing individual components and functions to ensure they work as intended.

- Integration Testing: Verifying the seamless integration of different modules within the app.

- System Testing: Testing the entire system to ensure that all components function correctly together.

- Performance Testing: Evaluating the app’s performance under different scenarios to ensure optimal speed and responsiveness.

- Security Testing: Assessing the app’s vulnerability to potential threats and ensuring data protection measures are in place.

QA Standards:

Adhering to standardized quality assurance (QA) standards is crucial in developing reliable and secure FinTech apps. By following established industry practices, companies can ensure consistent and effective QA processes. Some common QA standards in FinTech app development include:

- ISO 9000 series: Ensures a systematic and quality-controlled approach in development processes.

- OWASP: Provides guidelines and best practices for secure web application development.

- PCI DSS: Ensures compliance with security standards for payment card industry data protection.

Bug Fixing:

Throughout the testing process, it’s crucial to track and address any bugs or issues identified. Bug fixing involves investigating, isolating, and resolving software defects to improve the overall stability and functionality of the app. By promptly addressing bugs, FinTech companies can deliver a seamless user experience and build trust with their users.

Conclusion

Developing high-performance FinTech apps is crucial for success in the market. This article has highlighted the key factors to consider when creating these apps, including robust security, speed, and a user-centric design. By prioritizing performance optimization and a seamless user experience, FinTech apps can stand out and gain a competitive edge. Designing for speed and efficiency and ensuring robust security measures are vital to instilling trust in users and protecting their sensitive financial information.

Furthermore, integrating APIs into FinTech apps can enhance functionality by providing seamless access to third-party services and enabling efficient data sharing. This allows users to access a wider range of financial products and services within a single platform.

Ready to innovate and transform your business? Say hello to CodeBeavers!

If you are looking for ways to bring your product or app ideas to life? We’ve got your back. CodeBeavers has the tools and engineers you need to make your projects come alive. With CodeBeavers, you’ll be able to build faster than ever, deploy code with ease, and scale like never before. Send us your requirements now, and let’s start winning together.